|

Main preferences

Tax preferences of the FEZ «Vitebsk» |

|

|

|

|

|

|

The Administration of the Free Economic Zone «Vitebsk»

P. Brovky str. 50, 210605 Vitebsk The Republic of Belarus

Tel / Fax: +375 /212/ 26 08 02

E-mail: fez@vitebsk.by

http://www.fez-vitebsk.com |

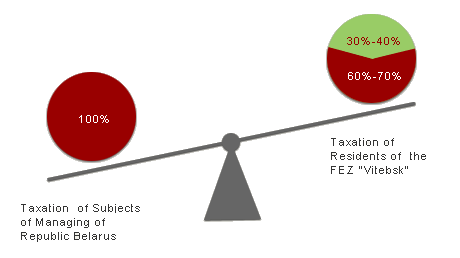

According to status on the FEZ “Vitebsk”, a special regime, which provides preferential conditions for business activities of companies, registered as FEZ “Vitebsk” residents is active on the territory of the Free Economic Zone “Vitebsk” The Free Economic Zone “Vitebsk” resident companies are subjects to the following fax privileges: The Free Economic Zone “Vitebsk” resident companies are subjects to the following fax privileges:

- 100% exemption from profit tax on own products and services within first 5 years from the moment of profit declaration and 50% in the years to follow;

- exemption from local dues (transport dues and dues on keeping infrastructure) in the period of exemption from profit tax (for 5 years from the moment of declaration).

- 3% exemption from one profit tax;

- exemption from the real estate tax;

- reduction of wage rate tax from 4% to 1%;

Preferences come in power from the first day of the month following the month of making agreement with the administration of the FEZ on the conditions of business activity on the territory of the FEZ “Vitebsk”.

For a period of functioning the FEZ “Vitebsk” (30 years) increase of range and rate of taxes is not allowed. International agreements of avoiding double taxation are active on the territory of the FEZ “Vitebsk”.

Regime of Free customs zone is characterized by the following peculiarities:

- When importing to the territory of FCZ customs duties and taxes are not collected and measures of economic policy are not applied:

- goods imported from outside the territory of Belarus or Russian Federation.

- goods imported from the territory of Russian Federation, goods from the third countries, put into free circulation in Russian Federation.

- When exporting from the territory of FCZ customs duties and taxes are not collected and measures of economic policy are not applied:

- goods exported outside the customs territory of Belarus or Russian Federation (export regime is claimed) if they are self-made products and defined as produced on the territory of Belarus.

- goods exported to the rest part of the customs territory of Belarus or to the territory of Russian Federation, which are self-made products and defined as produced on the territory of Belarus and import substitution products according to the range determined by the Government of the Republic of Belarus and coordinated with the President of the Republic of Belarus.

- exemption from customs duties and taxes when exporting products by resident of the FEZ to Russian Federation is performed in the order stated by the Decree of the President of the Republic of Belarus 9.060.2005 No 262.

Self-made products of the residents of the FEZ “Vitebsk” are not subjects for allocation and licensing on the export to the rest customs territory of Belarus and outside with the exception of products on which the Republic of Belarus has international obligations. There is a common customs space and the regime of free trade with the Russian Federation.

|